The Greatest Guide To Medicare Graham

The Greatest Guide To Medicare Graham

Blog Article

Excitement About Medicare Graham

Table of ContentsA Biased View of Medicare GrahamSome Known Factual Statements About Medicare Graham The Only Guide for Medicare GrahamNot known Details About Medicare Graham The Ultimate Guide To Medicare Graham

Prior to we speak about what to ask, let's discuss who to ask. There are a great deal of means to register for Medicare or to obtain the information you require prior to picking a plan. For numerous, their Medicare journey starts directly with , the main web site run by The Centers for Medicare and Medicaid Providers.

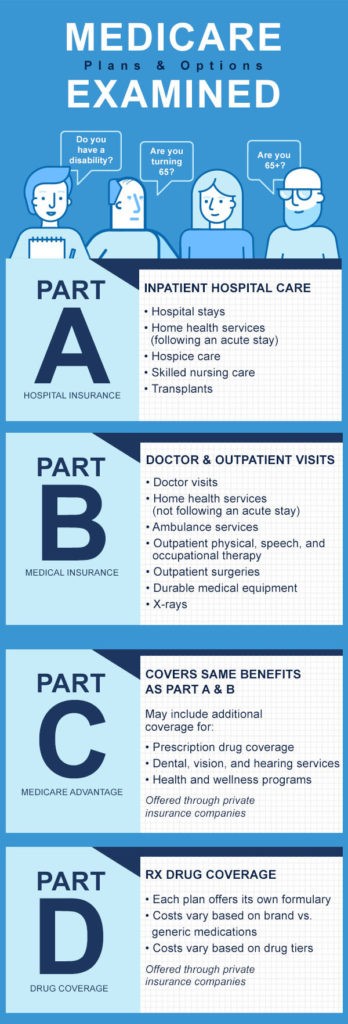

It covers Component A (hospital insurance) and Component B (clinical insurance). This includes things that are thought about clinically required, such as healthcare facility keeps, regular physician gos to, outpatient services and even more. is Medicare insurance coverage that can be acquired straight from an exclusive wellness treatment company. These plans work as a different to Original Medicare while using more advantages - Medicare.

Medicare Component D plans aid cover the expense of the prescription drugs you take at home, like your day-to-day medicines. You can register in a separate Part D plan to include drug insurance coverage to Original Medicare, a Medicare Cost plan or a few various other sorts of strategies. For lots of, this is frequently the initial question taken into consideration when looking for a Medicare plan.

Some Ideas on Medicare Graham You Should Know

To get the most cost-effective health care, you'll want all the services you use to be covered by your Medicare plan. Some covered solutions are totally cost-free to you, like mosting likely to the doctor for preventive care testings and tests. Your plan pays every little thing. For others like seeing the doctor for a lingering sinus infection or loading a prescription for covered antibiotics you'll pay a cost.

and seeing a company who approves Medicare. However what about taking a trip abroad? Lots of Medicare Advantage plans provide global protection, in addition to protection while you're traveling locally. If you prepare on taking a trip, make certain to ask your Medicare advisor regarding what is and isn't covered. Possibly you have actually been with your present physician for a while, and you intend to maintain seeing them.

An Unbiased View of Medicare Graham

Lots of people who make the button to Medicare proceed seeing their routine physician, but also for some, it's not that simple. If you're dealing with a Medicare expert, you can ask them if your medical professional will certainly be in network with your new strategy. However if you're considering strategies separately, you might have to click some web links and visit their website make some telephone calls.

For Medicare Advantage plans and Price plans, you can call the insurer to ensure the doctors you intend to see are covered by the strategy you want. You can additionally check the strategy's internet site to see if they have an on the internet search tool to locate a protected medical professional or center.

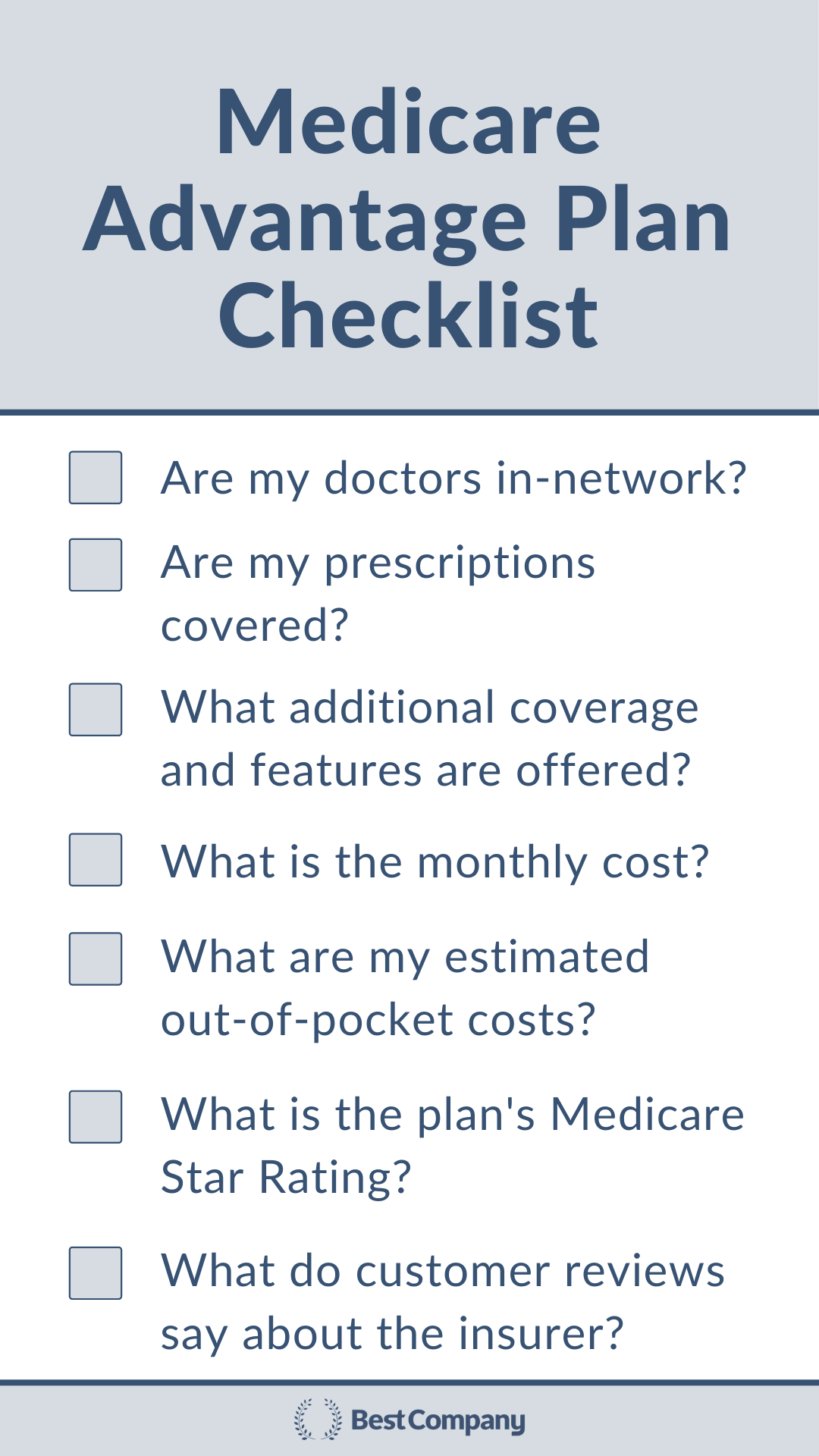

So, which Medicare strategy should you opt for? That's the very best part you have options. And ultimately, the choice depends on you. Remember, when obtaining begun, it is very important to see to it you're as educated as possible. Beginning with a list of considerations, ensure you're asking the right concerns and start concentrating on what type of plan will best offer you and your demands.

The Buzz on Medicare Graham

Are you ready to transform 65 and come to be recently qualified for Medicare? Choosing a plan is a huge decisionand it's not constantly an easy one. There are necessary points you should recognize up front. The least pricey plan is not necessarily the best option, and neither is the most expensive plan.

Even if you are 65 and still working, it's a great idea to review your choices. Individuals receiving Social Safety and security benefits when transforming 65 will certainly be immediately enrolled in Medicare Components A and B. Based upon your employment situation and health and wellness care options, you might need to take into consideration registering in Medicare.

Consider the different kinds of Medicare plans readily available. Initial Medicare has 2 parts: Component A covers a hospital stay and Part B covers clinical expenditures. Several individuals locate that Parts A and B together still leave gaps in what is covered, so they purchase a Medicare supplement (or Medigap) strategy.

The Basic Principles Of Medicare Graham

There is generally a premium for Component C policies on top of the Part B costs, although some Medicare Advantage prepares offer zero-premium strategies. Medicare Near Me. Evaluation the coverage details, expenses, and any kind of added advantages supplied by each plan you're considering. If you sign up in original Medicare (Parts A and B), your premiums and coverage will be the very same as other individuals who have Medicare

(https://www.startus.cc/company/medicare-graham)This is the most a Medicare Advantage participant will certainly have to pay out-of-pocket for protected solutions each year. The amount differs by plan, but when you reach that restriction, you'll pay absolutely nothing for protected Part A and Part B services for the rest of the year.

Report this page